Sunday, November 20, 2011

The Economics of the Worst Meal I Ever Ate

Thursday, September 22, 2011

Gotomeeting's TV Ad: Slacktivism In Action

"a portmanteau formed out of the words slacker and activism. The word is usually considered a pejorative term that describes 'feel-good' measures, in support of an issue or social cause, that have little or no practical effect other than to make the person doing it feel satisfaction. The acts tend to require minimal personal effort from the slacktivist."

But this isn't just slacktivism. It is worse. This is slacktivism used to make money. This commercial is used to associate the company, Gotomeeting with fictional well-intentioned folks bringing fictional clean water to fictional Kenyan villagers, which in turn elevates the public's view of Gotomeeting, bringing the company not-fictional money.

So does the fact that this commercial showcases the non-existent "Kenyan Water Project" promote the clean water cause? Not at all. If anything, this feel-good commercial harms the real cause it hijacks, because the worst part of slacktivism is that it breeds complacency. Because who needs to start a real charity when there's a fictional one out there in TV land doing fictional good?

Sunday, September 18, 2011

Pictorial Evidence of the Benefits of Relaxed Drug Policy

- Stabbings

- Shootings

- Bombings

- Good old-fashioned ass-whoopings

- Leg breaking

- Blackmail

- Vandalism

- Kidnapping

- Etc. etc. etc.

I'm not denying that this is a complex issue. Drugs cause harm to society; one must only look to the devastating effects of alcohol and tobacco to see this. However, I think there's one thing everyone can agree on: boycotts are better than bombings.

Monday, August 15, 2011

If You Are Advertising, There Must Be Something Wrong With You

Have you ever watched a "featured" or "promoted" video on Youtube? I haven't watched them very often, because from my experience, they usually suck. Why else would someone need to pay to get his or her video high up in the listings? Really good videos gain popularity organically. Ironically, at least for me, seeing that a video on Youtube is "featured" is the kiss of death, and guarantees that I will not watch it. "Featured Video" is the mark of a bad video that is probably trying to sell something. A video's mark of quality can only come from a large number of "thumbs up" ratings. This is a democratization of the whole marketing environment. You can see it everywhere on the web, not just on Youtube. Star and thumbs up systems provide a collective intelligence that can communicate to everyone which products and services are truly worthwhile. These collective rating systems are one reason that advertising is becoming less relevant in today's wired world. Though today there are more and better opportunities to reach your customers through advertising than ever before, advertising itself is taking a backseat to organically-spread word of mouth. Word of mouth rules, and now that there are automated ways to instantly and globally spread word of mouth, advertising has taken a new, secondary place. For example, if advertising misleads, word of mouth, or rather, word of type or click, can correct things eventually. If a company promises amazing results from a product, a consumer must only check user reviews on one of many websites to get the real scoop from people who have actually used it (though maybe also a scattering of fake reviews marketing people at the company have thrown in there). So this leads me to what I think is a new law of marketing in our viral world: if you are advertising there must be something wrong with you. I am being slightly facetious. This is an exaggeration. No matter how easily word of mouth can spread, companies will need to advertise. Some industries need advertising more than others. And even the best companies will need to advertise, at the very least to get the viral marketing snowball going in the first place. But if you take a look at who is doing the most advertising nowadays, you're going to see a lot of predatory lenders, shady herbal supplement companies and expensive trade schools, not so much reputable and well regarded companies. Many of the best companies may have found that they can thrive from the free advertising of web-based word of mouth. Perhaps our collective intelligence on the web will lead to a world where companies, (gasp!) must actually make a decent product to survive.

Wednesday, August 10, 2011

Web Advertising Bubble?

|

| The Ugly Side of Web 2.0 Marketing: A Facebook Toilet Paper Poll |

Tuesday, August 9, 2011

Hydrolyze This

Saturday, June 18, 2011

The Invisibility Cloak: Bad for Human Rights?

Now before all you sci-fi and fantasy fans go nuts, just ponder the question: what are the possible uses for an invisibility cloak? I think you'll come to the conclusion that an invisibility cloak would mostly be useful for two things: mischief and mayhem. If invisibility cloaks became widely available to the public, the crimes of peeping toms, shoplifters and murderers for example would all become easier to get away with. Which brings me to the subject of human rights. To understand the full ramifications of widespread invisibility, it's useful to become familiar with the idea in law and economics, of a mathematical equation for the "optimal punishment" for a crime. Donald Wittman's excellent textbook on law and economics explains this concept the best. Because not all criminals can be caught, in order to make them face the full costs their crimes bring upon society "...the expected punishment, probability of being punished (P) times the fine (F), is set equal to the harm of the crime. That is PF = H. Thus the lower the probability of being caught, the higher the level of punishment should be." In other words, for the legal system to adequately dissuade people from committing crimes, two things are possible: 1) increasing the probability of catching the criminal, or 2) increasing the punishment. So the necessary punishment F varies inversely with the probability of being caught. So if suddenly it were half as likely for someone to get caught for a particular crime, to maintain optimality, the punishment must become twice as harsh. This seems to explain at least in part why countries without advanced systems of crime detection and law enforcement (low P) may punish small crimes with huge punishments (high F, e.g. cutting off someone's hand for shoplifting, or hanging, drawing and quartering for various crimes in medieval England).

So what does this have to do with invisibility cloaks? Clearly, (no pun intended), if invisibility cloaks became cheap and widely available to criminals, the probability of getting caught (the P in the optimal punishment equation), for many crimes would decrease. Most crimes would become easier to get away with by use of an invisibility cloak. But not only would it help in the perpetration of crimes, an invisibility cloak would help people resist arrest for any crime, even those not utilizing invisibility, such as cybercrime and fraud perhaps. If the cops came to your door, you could just slip on your invisibility cloak and make a break for it.

So in a world of widespread invisibility crimes, to once again make criminals fully face the costs they bring to society, the legal system could greatly increase F, the punishment, or alternatively attempt to bring P back up to its original levels, perhaps by becoming ever more invasive into peoples lives. Either way an invisibility cloak sounds like bad news, both for the possible victims of invisibility related crimes and for human rights in general. I personally wouldn't want shoplifting a pack of gum to be punishable by years in prison just because pesky invisible people have ruined the legal system for everybody.

Haven't these scientists seen "Hollow Man" or "Predator"?

Sources:

http://articles.nydailynews.com/2010-03-20/news/27059544_1_invisibility-cloak-dimensions

Donald Wittman, Economic Foundations of Law and Organization, Cambridge University Press, 2006

Tuesday, June 14, 2011

Party-nomics, Facebook and Positive Network Externalities

Note the steep drop-off at a certain point, when the number of partygoers reaches the maximum capacity of the party's physical location. Clearly people like a good party, but no one wants to get squished. As you can see, the appeal of a party is a function of the number of people already there, and this determines how many people will want to join that party in the future. The self fulfilling prophesy is in full effect. Because of this, the success or failure of a party depends largely on the number of people attracted in the initial stages, and this can depend largely on chance. When a party has reached a "tipping point" of popularity through word of mouth, it can fill up to the point of reaching the maximum capacity of the party's physical location. Then there will be spillover to the less popular parties, and a new equilibrium will be reached.

Note the steep drop-off at a certain point, when the number of partygoers reaches the maximum capacity of the party's physical location. Clearly people like a good party, but no one wants to get squished. As you can see, the appeal of a party is a function of the number of people already there, and this determines how many people will want to join that party in the future. The self fulfilling prophesy is in full effect. Because of this, the success or failure of a party depends largely on the number of people attracted in the initial stages, and this can depend largely on chance. When a party has reached a "tipping point" of popularity through word of mouth, it can fill up to the point of reaching the maximum capacity of the party's physical location. Then there will be spillover to the less popular parties, and a new equilibrium will be reached.But what about a party with no physical location, other than tiny ones and zeroes occupying a server? Yes I am talking about the internet, and specifically the huge social gatherings that occur 24/7 on social networking sites like Facebook and Twitter. Just like a parties, these sites bring positive network externalities to their users. Meaning, the more people there are on Facebook, the more beneficial it is for a new person to join Facebook. But unlike parties, huge websites do not face the constraints of physical space. So, roughly graphing the benefit of being on a social networking website in response to number of users would look something like this:

Rather than a drop in total fun occurring at the point of some number of users as we saw with the physical party, there is simply a levelling off. There are diminishing marginal returns to fun here, because, for example with Facebook, you can only have so many Facebook friends (5000 as of today I believe, and even fewer you really interact with on a regular basis). But there is no drop-off in benefit, because there is no restriction on capacity. Unlike a real physical party, this party on the internet shows no sign of slowing down. Facebook has become a fixture, and it would be very difficult for another company to come in and compete with it on its own turf. A new site would need to provide amazing new benefits to compete with the massive positive network externalities Facebook has built up through its user base. And why did Facebook build up such a large base of users? Partially because it's a very well designed site, but also because of the initial luck of the draw. Mark Zuckerberg's party got the initial rush of partygoers it needed to sustain itself and grow. Without any capacity restrictions, it seems to be here to stay. Even if there were a better party next door, people would probably ignore it.

Rather than a drop in total fun occurring at the point of some number of users as we saw with the physical party, there is simply a levelling off. There are diminishing marginal returns to fun here, because, for example with Facebook, you can only have so many Facebook friends (5000 as of today I believe, and even fewer you really interact with on a regular basis). But there is no drop-off in benefit, because there is no restriction on capacity. Unlike a real physical party, this party on the internet shows no sign of slowing down. Facebook has become a fixture, and it would be very difficult for another company to come in and compete with it on its own turf. A new site would need to provide amazing new benefits to compete with the massive positive network externalities Facebook has built up through its user base. And why did Facebook build up such a large base of users? Partially because it's a very well designed site, but also because of the initial luck of the draw. Mark Zuckerberg's party got the initial rush of partygoers it needed to sustain itself and grow. Without any capacity restrictions, it seems to be here to stay. Even if there were a better party next door, people would probably ignore it.Saturday, May 28, 2011

Value of a Bird in the Hand in Terms of Birds in Bushes

Is a bird in the hand really worth two in the bush? A GEICO commercial, where an antiques appraiser values a sculpture of a bird in the hand as worth "two in the bush" got me thinking about that expression. Maybe a bird in the hand is really worth 3 or 5 birds in the bush. I'm no bird hunter, but I am an amateur economist, and I know to find the value of a bird in the hand in terms of birds in bushes, we can break it down mathematically. The expression "a bird in the hand is worth two in the bush" can be mathematically expressed by the following equation: valueOfBirdInHand = 2*valueOfBirdInBush

Is a bird in the hand really worth two in the bush? A GEICO commercial, where an antiques appraiser values a sculpture of a bird in the hand as worth "two in the bush" got me thinking about that expression. Maybe a bird in the hand is really worth 3 or 5 birds in the bush. I'm no bird hunter, but I am an amateur economist, and I know to find the value of a bird in the hand in terms of birds in bushes, we can break it down mathematically. The expression "a bird in the hand is worth two in the bush" can be mathematically expressed by the following equation: valueOfBirdInHand = 2*valueOfBirdInBush 2) The fixed costs involved with going bird-catching in the first place. By fixed costs, meaning the same amount of these costs must be incurred regardless of the bird-yield.

totalValue= P(catching bird)*numBirds*unitValue - (numBirds*unitVariableCost) - fixedCost

with P(catching bird) denoting the probability of catching a bird given that it is in the bush. Unit value gives a measurement of value to a caught bird, for example the prevailing market rate for that particular bird.

To explain this perhaps perplexing equation, P(catching bird)*numBirds*unitValue gives the total expected value, meaning you might catch 50% of 10 birds valued at $20 each for $100 total yield, or 25% of 12 birds valued at $5 each for a $15 yield. NumBirds*unitVariableCost gets you your total variable cost. Subtract that out along with your fixed cost and you have the expected net value of your hunting trip. It's like an expected profit.

P(catching bird)*numBirds*unitValue - (numBirds*unitVariableCost) - fixedCost = unitValue

numBirds*(P(catching bird)*unitValue - unitVariableCost)=unitValue+fixedCost

divide both sides by (P(catching bird)*unitValue-unitVariableCost)) and we have our answer:

numBirds=(unitValue + fixedCost)/(P(catching bird)*unitValue-unitVariableCost)

This equation answers the question of how many birds in the bush equal the value of one bird in the hand! For example, let's say birds were worth $10 each, the probability of catching a bird in a bush was 0.50, and there were zero fixed or variable costs involved with bird catching. In this case:

numBirds = ($10 + 0)/(0.50*$10 - 0)

numBirds = 1/0.50

numBirds = 2

Thus in that situation a bird in the hand is worth two in the bush, just like the expression tells us.

But what if there were fixed and variable costs involved with hunting for birds? What if you needed to pay a $5 fee to go bird hunting, and it cost you $1.00 per bird to get it ready for market? Then:

numBirds = 3.75

So in this case a bird in the hand would be worth 3.75 birds in the bush.

Now what if, keeping the costs the same, the probability of catching a bird in a bush decreased to 0.25?:

numBirds=($10+$5)/(0.25*$10-1)

numBirds=15/1.5

numBirds=10

In this case a bird in the hand would be worth 10 birds in the bush.

So after all these mathematical gyrations you might think I'm being silly just like the GEICO commercial. Well, yes I am being silly but there are also valuable economic lessons to be learned here. You can replace "bird" with any other thing of value, and the simple economic model I have assembled here, as well as the wisdom of the expression it was based on, would be just as valid. The old saying examines one of the great conflicts in economic life: the sure thing vs. speculative gain. For more on that topic check out my article on the game show "Deal or No Deal".

The moral of the story is: to evaluate a decision, look at the probability of a favorable outcome, look at the variable costs, and look at the fixed costs.

Sunday, April 24, 2011

False Quantity Discounts and Chocolate Bunnies

Knowing there was a chance that this Rite-Aid didn't have a POS system sophisticated enough to handle a real quantity discount, and hungry for a bunny, I bought just one item. And just as I had guessed, this wasn't a real quantity discount, just a re-setting of the price to $1.50 per unit. Here's the proof:

Knowing there was a chance that this Rite-Aid didn't have a POS system sophisticated enough to handle a real quantity discount, and hungry for a bunny, I bought just one item. And just as I had guessed, this wasn't a real quantity discount, just a re-setting of the price to $1.50 per unit. Here's the proof:

(Disregard that I was also buying earplugs and a glasses case that, as it turns out is not intended for my gender. Chocolate bunny is line three.)

As you can see, not only was it unneccessary for me to buy two rabbits to get the discount, but I also got that one rabbit cheaper than advertised. This begs the question: why would a retailer ever sell something for cheaper than advertised? I've heard of bait and switch, but this is like bait and switch in the customer's favor. The only reason for a policy such as this must be that some retailers choose not incur the costs of implementing and maintaining more detailed POS system that can handle a quantity discount. Not knowing what the costs are, I can't judge whether this is the right or wrong choice. All I know is that such a policy lowers revenue.

Friday, April 8, 2011

Why Bubbles are Bad: The Long Term

Olivier Blanchard, Macroeconomics, Fourth Edition, 2006, Pearson/Prentice Hall , Pg. 328 http://www.thecrimson.com/article/2008/6/22/harvard-graduates-head-to-investment-banking/#

Monday, March 28, 2011

Can You Make Sense Of This Chart?

Monday, February 21, 2011

An Increase in the Supply of Embarrassment

So should everyone live in a constant state of fear of messing up in front of a camera (e.g. Cristina Aguilera and "the twilight's last reaming")? Don't worry, here comes economics to the rescue!

As you can see, the supply curve has shifted outwards as technology makes a greater quantity of embarrassing videos available. This increases the quantity viewed from Q1 to Q2, but also decreases the value that people place upon each individual embarrassing videos from P1 to P2. This can be very intuitively understood. If there were suddenly twice as many videos of, say, ballroom dancing accidents, each individual video will be less special to each consumer. There are only so many ballroom dancing accident videos consumers will be able to watch within their schedules. With an increased supply, the level of cultural saturation each individual viral video achieves is nothing like the earlier days of the internet. With an increase in supply, viral videos as a whole become more prevalent, but each individual video becomes less distinctive and culturally valued.

As you can see, the supply curve has shifted outwards as technology makes a greater quantity of embarrassing videos available. This increases the quantity viewed from Q1 to Q2, but also decreases the value that people place upon each individual embarrassing videos from P1 to P2. This can be very intuitively understood. If there were suddenly twice as many videos of, say, ballroom dancing accidents, each individual video will be less special to each consumer. There are only so many ballroom dancing accident videos consumers will be able to watch within their schedules. With an increased supply, the level of cultural saturation each individual viral video achieves is nothing like the earlier days of the internet. With an increase in supply, viral videos as a whole become more prevalent, but each individual video becomes less distinctive and culturally valued.

So what does this economic reasoning mean for those who have been and will be embarrassed by viral videos? Basically it's good news. While new technologies have made it so much easier to be embarrassed in front of a global audience, the abundance of supply will keep the cultural value of each embarrassing moment low, to the point that new videos may not have the universal appeal of earlier ones that became global phenomena. This decrease in cultural value and recognition in turn makes each embarrassing viral video less embarrassing. For this reason, people, especially public figures who are constantly in front of cameras, should not live in fear of slipping up and becoming the next embarrassing viral phenomenon. Excessive carefulness can be a hazard, especially in politics where the cameras are always rolling. People should act naturally as ever. Because in the future, as the internet continues to churn out mountains of content, the public's reaction to a possible viral phenomenon may just be "meh".

Its a new age where everything is out there for all to see. But that gets boring after a while, doesn't it?

Friday, January 28, 2011

EBT (food stamps) and Fast Food: Implications for Market Demand

In short, this change in policy creates a kink in the demand curve for fast food, as low income EBT recipient customers increase their demand, while demand by higher income customers does not change.

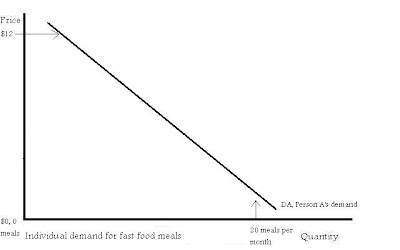

Consider two fast food buying customers. Person A earns an income that disqualifies him from EBT. Person B earns a low enough income to qualify for EBT, and has chosen to receive those benefits.

Now consider Person B's more modestly budgeted demand curve. This is person B's demand for fast food meals before the change in policy that allows him to purchase fast food with EBT.

Notice how at a price of $12 per meal Person B will not buy any fast food meals. This is beyond his budget at this point. So what happens to Person B's demand curve when suddenly he can use EBT to purchase these meals? This change in policy will shift his demand curve for fast food to the right, because he will now be more able to purchase fast food meals at various prices. Here's his new demand curve:

We have now seen the effects of this change in policy on two individuals, one on food stamps and one not. But what about the market demand curve? And what does this mean for market equilibrium (the point where the quantity demanded equals the quantity supplied)? Let's find out. Because the market demand curve is the summation of all the individual demand curves, just imagine adding together all the demand curves for all the Person A-s and Person B-s of the market. Let's say the demand and supply curves before the policy change look like this:

The market price is at P1 and the quantity sold is at Q1. Suddenly the county government for this market allows EBT to be used to buy fast food. What would this do to the demand curve? Because higher income, non-food-stamp recipient customers like person A can affect the entire market demand curve, from the highest prices to the lowest, and lower income food-stamp recipient customers like person B would tend to only affect the lower parts of the demand curve, when EBT is suddenly allowed for fast food purchases, it is only the lower parts of the demand curve that will shift outward (in reality the change would probably not be this prominent but I have made it prominent just for demonstration). Here is the new market demand curve:

The market price is at P1 and the quantity sold is at Q1. Suddenly the county government for this market allows EBT to be used to buy fast food. What would this do to the demand curve? Because higher income, non-food-stamp recipient customers like person A can affect the entire market demand curve, from the highest prices to the lowest, and lower income food-stamp recipient customers like person B would tend to only affect the lower parts of the demand curve, when EBT is suddenly allowed for fast food purchases, it is only the lower parts of the demand curve that will shift outward (in reality the change would probably not be this prominent but I have made it prominent just for demonstration). Here is the new market demand curve: The result is a kink in the demand curve pushing out at the point where most food stamp recipients would be priced out of the market. Assuming the supply curve is below that point, this increases the equilibrium price to P2 and the equilibrium quantity to Q2. Thus this policy is a good thing for fast food companies, increasing their revenue by the amount of:

The result is a kink in the demand curve pushing out at the point where most food stamp recipients would be priced out of the market. Assuming the supply curve is below that point, this increases the equilibrium price to P2 and the equilibrium quantity to Q2. Thus this policy is a good thing for fast food companies, increasing their revenue by the amount of:Monday, January 24, 2011

How Not to Package Your Product

Thursday, January 13, 2011

Weirdest Billboard Ever?

Sunday, January 2, 2011

How Did My "Saw 3D" Prediction Hold Up?